Switzerland reported on over 3,4 million financial accounts under the automatic exchange of information in

Now you see me, now you don't: using citizenship and residency by investment to avoid automatic exchange of banking information - Tax Justice Network

Common Reporting Standard: Survivor's Guide to OECD Automatic Exchange of Information of Offshore Financial Accounts: Aggarwal, Eesh: 9781523298037: Amazon.com: Books

OECD Tax on Twitter: "Global network for automatic exchange of #tax information: +100 jurisdictions get ready to exchange #CRS information as of Sep 2018. See ➡️ https://t.co/geqdUwjwQ2 https://t.co/Tc476zLQp7" / Twitter

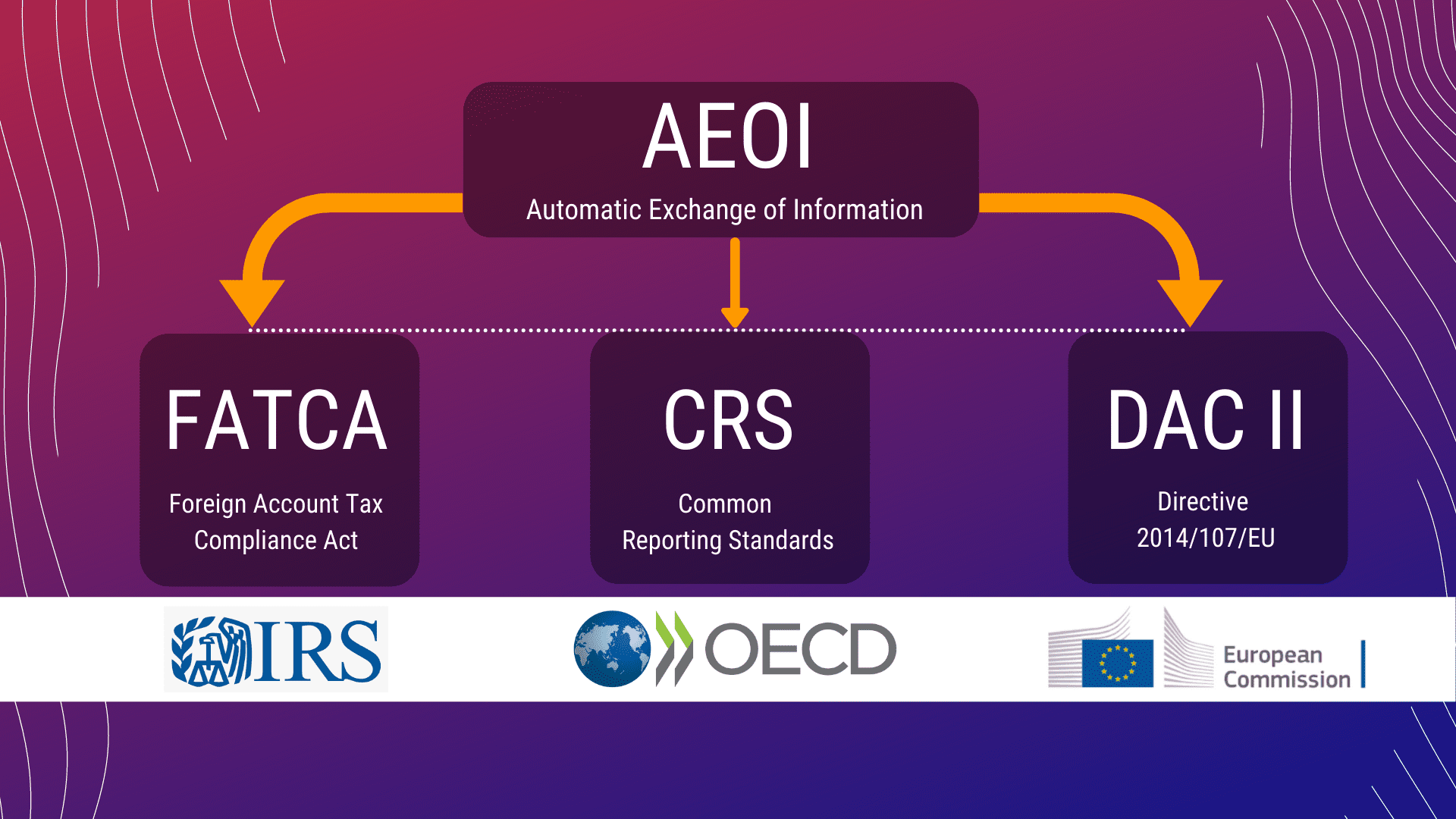

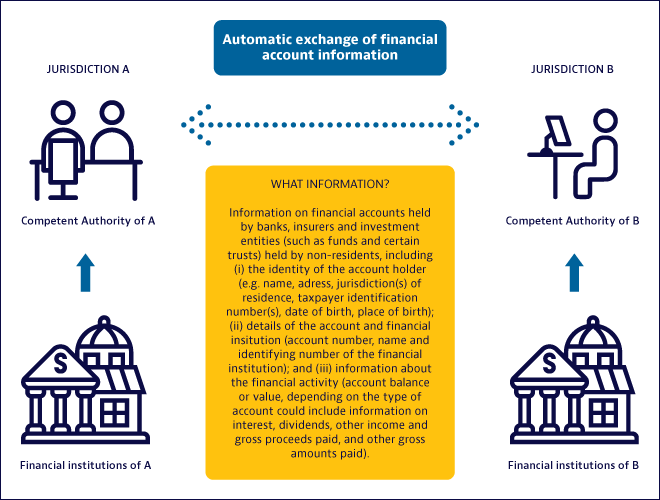

1 The Exchange of Information Chartflow in AEOI Source: Presentation... | Download Scientific Diagram