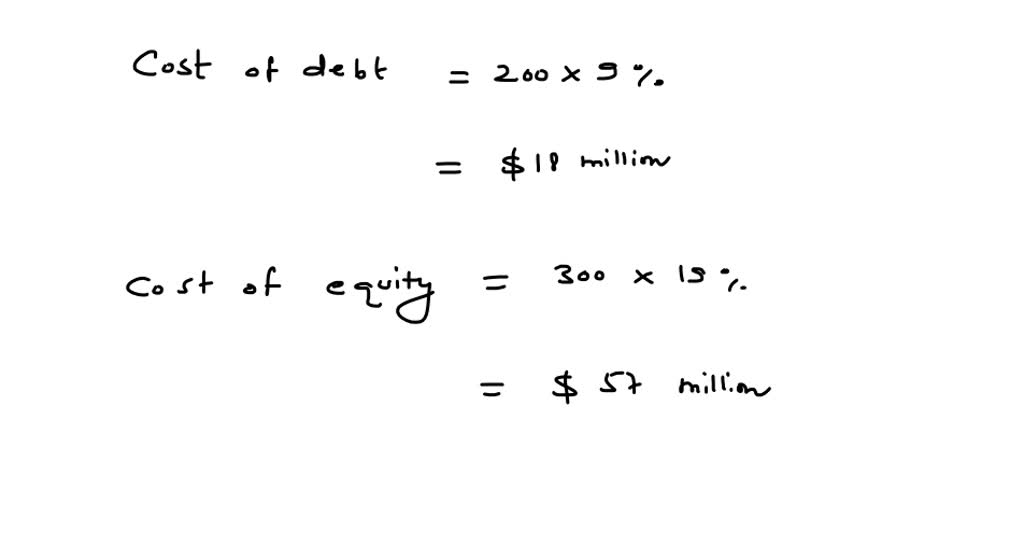

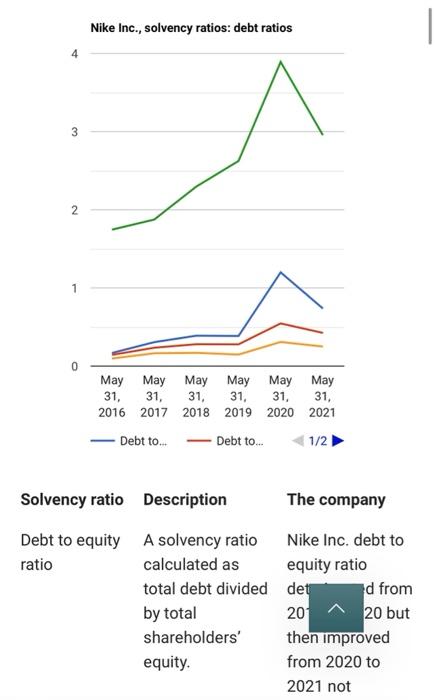

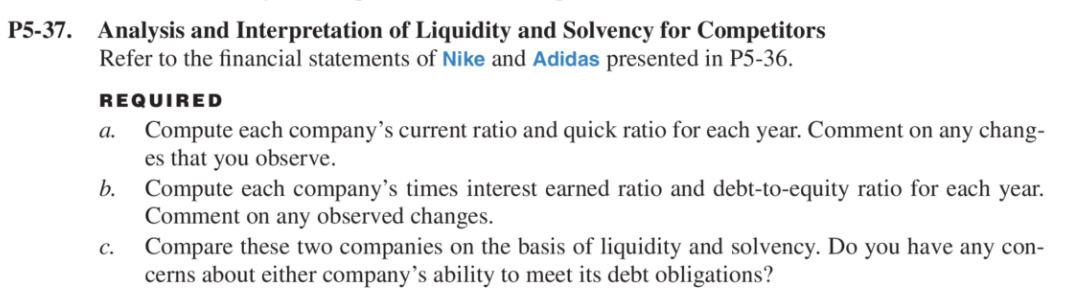

SOLVED: Nike, Inc., has a debt-equity ratio of 2.3. The firm's weighted average cost of capital is 10 percent and its pretax cost of debt is 6%. The tax rate is 24%.

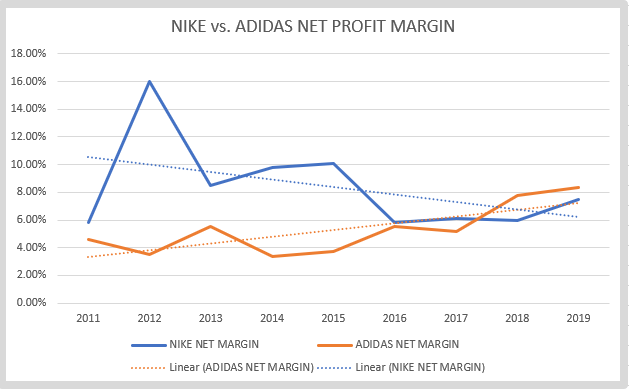

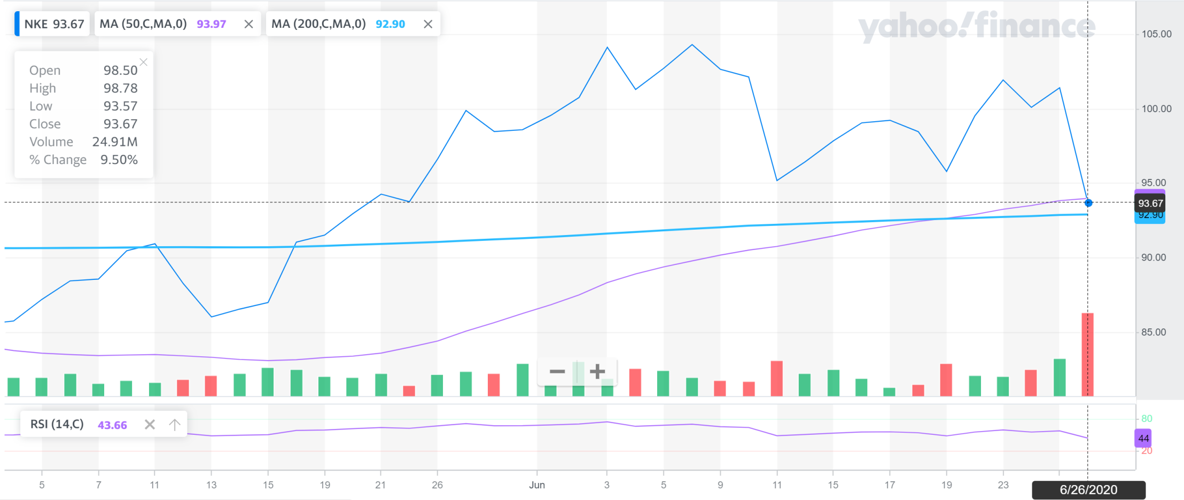

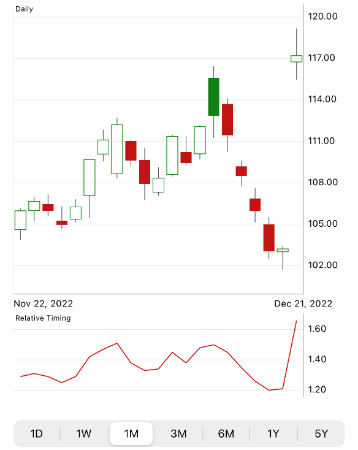

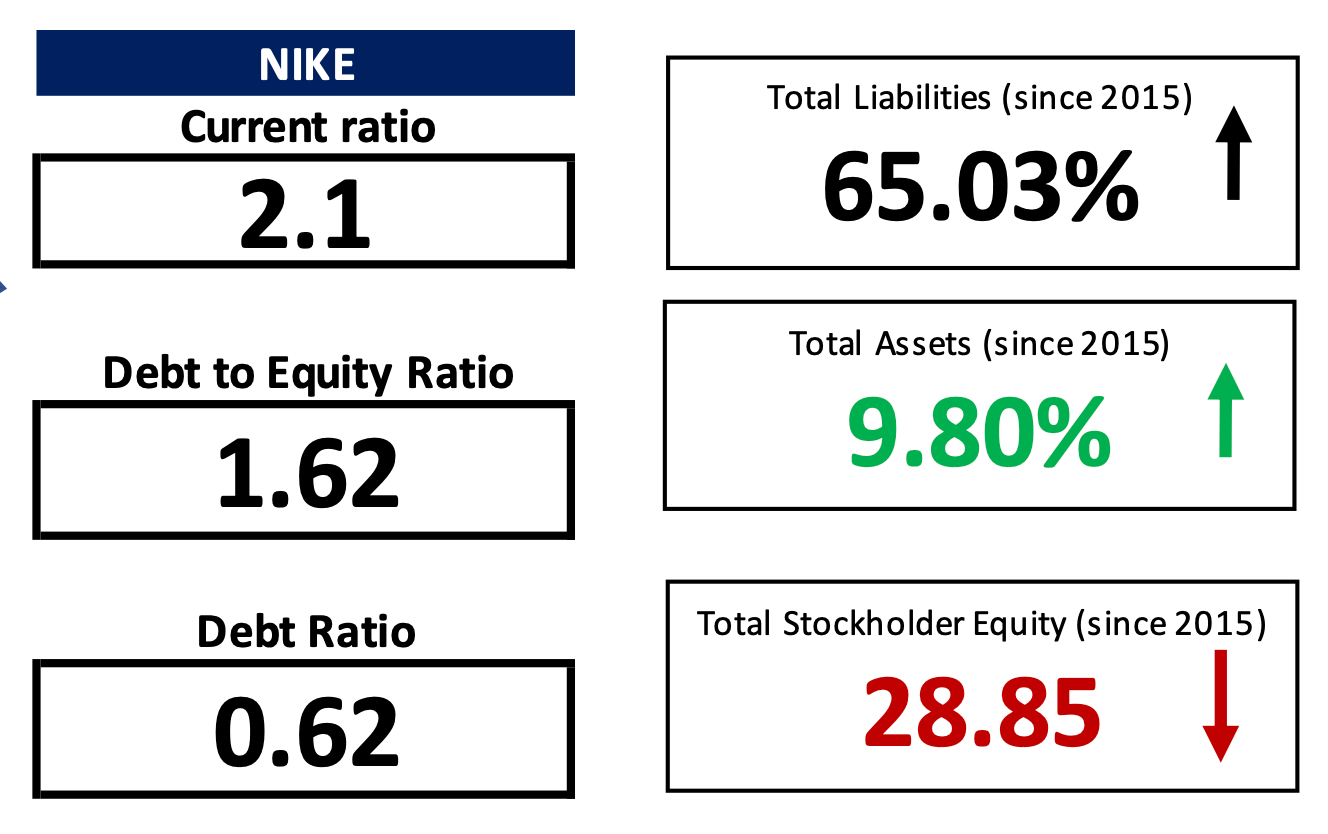

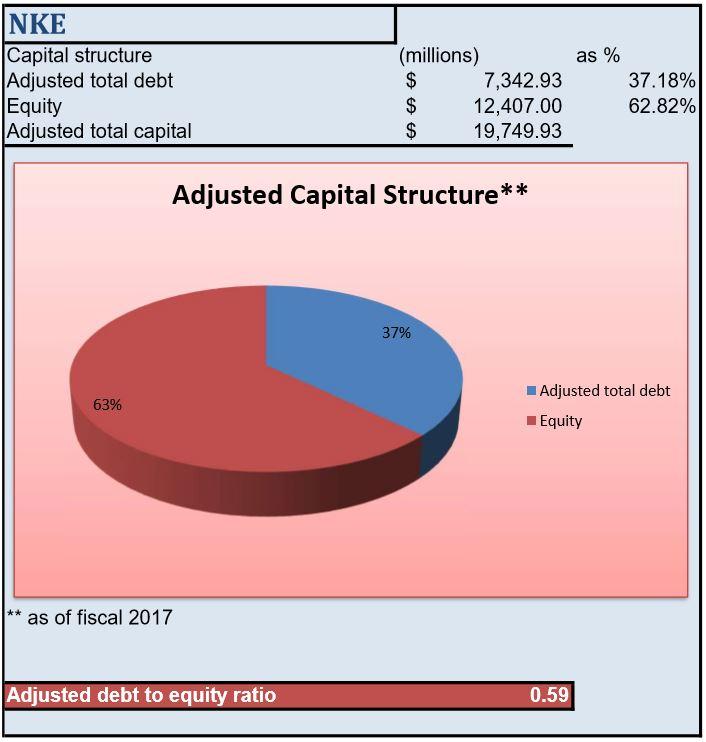

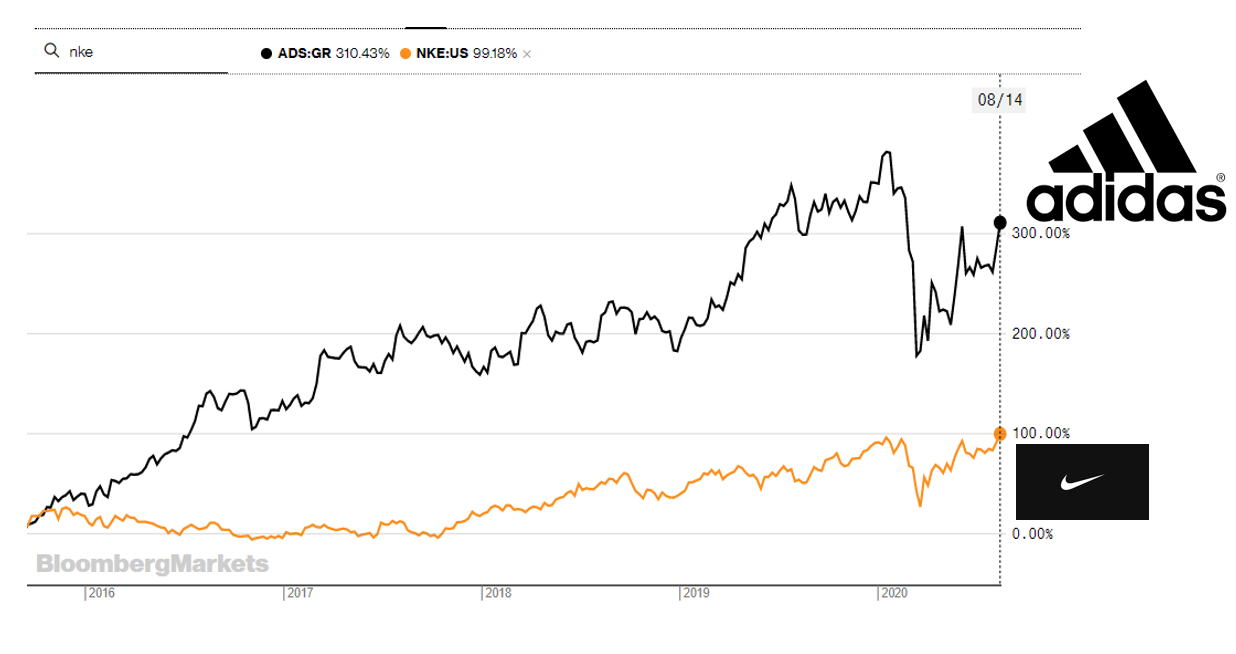

Nike vs Adidas: Where to Invest?. Nike and Adidas are both known brands… | by Kathleen Lara | Medium

:max_bytes(150000):strip_icc()/Long-TermDebttoCapitalizationRatio_v2-b70165af646d45b29590b1a852aa8876.jpg)